In JAPAN

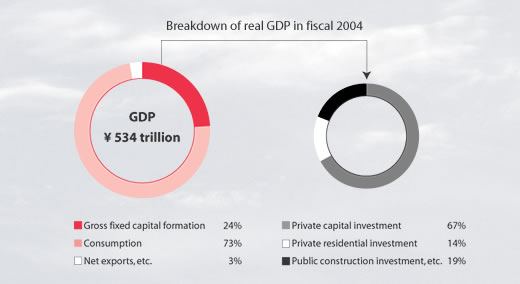

The Japanese economy continued to undergo a gradual recovery in fiscal 2004, led by private-sector capital investment. Evidence for this recovery is seen in the nation's GDP, which grew by 1.9% year-on-year for its third consecutive increase. Confidence in the persistence of this recovery trend waned somewhat in the second half of the term, however, against the backdrop of a slowdown in exports owing to the strength of the yen, as well as the dampening effects of inventory adjustment in the digital electronic appliance industry. In the Company's business fields of housing and other construction, the business performance of most companies was flat, with some firms recording slight year-on-year declines.

Construction of buildings and houses in Japan

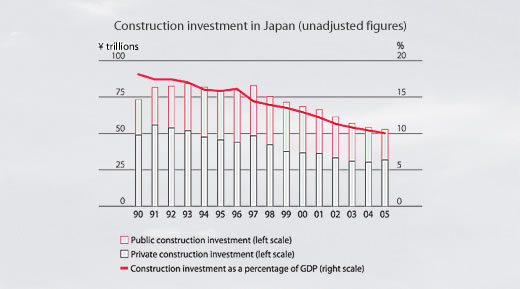

Total construction investment in fiscal 2004 declined 2.2% year-on-year to ¥52.77 trillion, representing a falloff of approximately 40% from the peak year of 1992. As a percentage of the nation's GDP, this investment figure, at 10.4%, has been roughly halved by comparison with the 20.1% figure recorded in 1980. Owing to the government's fiscal restraint policy, the falloff in construction investment has been particularly dramatic in public works investment, which decreased by around 10% each year for three straight years, ending at ¥21.08 trillion in fiscal 2004.

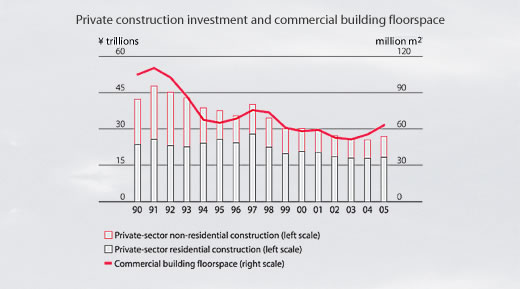

Private-sector housing investment, on the other hand, registered a slight year-on-year growth in fiscal 2004, by 2.2% to ¥18.27 trillion. Housing construction starts in the reporting period grew by 1.7% to 1.19 million for the second consecutive increase. In the category of owner-occupied houses, construction starts were down slightly year-on-year, but in the construction of both rental housing and in lot-subdivision (single-family house development and condominiums), year-on-year growth in construction starts was recorded. In lot-subdivisions, single-family houses were particularly in demand, with construction starts posting a strong 7.8% rise over the previous term for their second straight year of growth.

Turning to private-sector non-residential construction investment, companies generally adopted a proactive stance on capital investment, particularly in the manufacturing sector, and thanks to this total investment in this category was up 11.7% over the previous term, at ¥8.51 trillion. The floorspace of all types of buildings on which construction was started registered a year-on-year increase of 3.5%, with especially sharp growth of 36.0% being posted by the floorspace of manufacturing plant construction starts. In floorspace terms, other categories of building also rose over the previous year's level, although by smaller percentages, with offices up 9.6%, warehouses up 8.8%, and retail outlets up 7.5%.