Basic Strategy for Capital Policy

Basic strategy for capital policy

Considering sustained growth necessary to achieving increases in shareholder value over the medium to long term, the Company recognizes the need to maintain a level of shareholders’ equity that allows for investment in growth and a tolerance for risk.

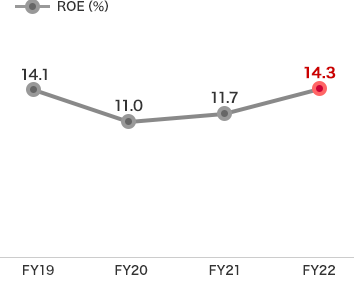

Considering return on equity (ROE) to be one of its topmost management priorities, the Company discloses its targets. To effectively deploy shareholders’ equity and ensure a robust financial base that allows for the raising of funds for investment in stable growth, the Company discloses its target D/E ratio and other measures for financial soundness and works to create the optimal capital structure for reaching these targets.

ROE and target values for measurement of financial soundness

During the period under the Seventh Medium-Term Management Plan (April 2022 to March 2027), the Company aims to achieve an ROE of 13% and higher and a D/E ratio of approximately 0.6 as one of its management targets.

Basic Strategy for Capital Policy(PDF 33KB)

(Corporate Governance Guidelines)

Book-value per share and net assets ratio

Interest-bearing liabilities and D/E ratio

※D/E ratio after taking the issurance of hybrid bonds into account

ROE