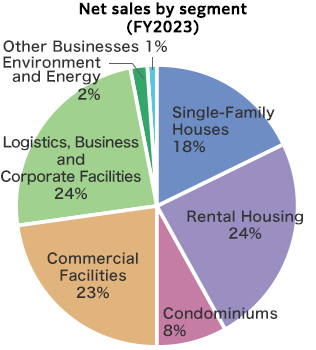

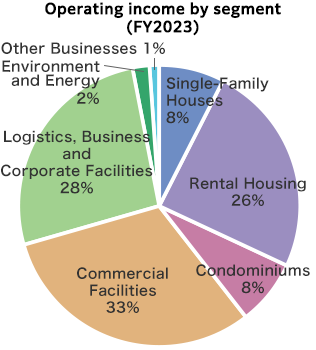

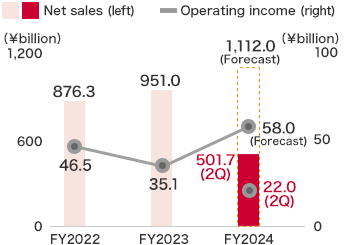

Business Segment*This page is updated semi-annually.

The percentage figures for breakdown of net sales and operating income by segment

- *Net sales represents sales to external customers.

- *Adjustments are included in the total but not shown on the graph. The percentage of each segment does not add up to 100%.

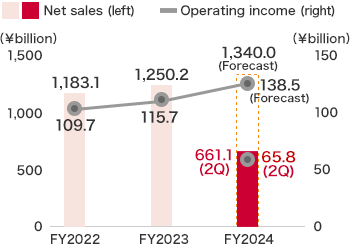

Single-Family Houses Business

In the Single-Family Houses Business segment, we provided high-quality housing with excellent energy efficiency and resilience performance amid the diversification of housing styles. We stayed close to residents’ lives and their changing values to propose lifestyles that will enhance their lives.

In the domestic housing business, the Company promoted the “Ready Made Housing.” concept for built-for-sale houses. Despite the soaring cost of labor, housing construction materials and other goods, the Company provides high-quality built-for-sale houses that aim to be worth more than their price, offering the same design excellence and quality as custom-built houses, a reassuring long-term home warranty, and after-sales support.

For custom-built houses, the Company promoted the “Smart Made Housing.” concept providing the benefits of both custom designs and standardized houses. In January 2025, the Company launched xevo M3, the first of the Company’s lightweight steel framed three-storied single-family housing products to meet ZEH (Net Zero Energy House) requirements as standard, with the Company’s original “Internal and External Double Insulation” and solar power generation system.

Anticipating a society with a high demand for housing stock, the Company is focusing on the revitalization and regeneration of existing buildings. Especially in housing complexes developed by the Company, it works on the Livness Town Project, which aims to regenerate and redevelop communities by addressing social issues such as community revitalization and the problem of vacant houses. The Company tries to put itself in the shoes of those who live there and maintains a close relationship with the communities and the residents’ daily lives, so as to enhance the value of communities and ensure they remain attractive places to live for many years more.

Overseas, the Group has been expanding its operations in the eastern, southern and western regions of the U.S., which it calls the smile zone. Three Group companies, Stanley Martin Holdings, CastleRock Communities and Trumark Companies play a key role in the east, south and west respectively. In the fiscal year 2024, they offset the impact of persistently high housing loan interest rates with efforts to expand unit sales by taking advantage of incentive measures such as mortgage buydown and efforts to cut costs by shortening construction periods. In each region, orders received have been strong recently, thanks to a strategically planned increase in the number of lots for sales, coinciding with the spring sales period.

As a result, net sales for this segment amounted to 1,144,505 million yen (+20.3% year on year), while operating income came to 69,826 million yen (+98.6% year on year).

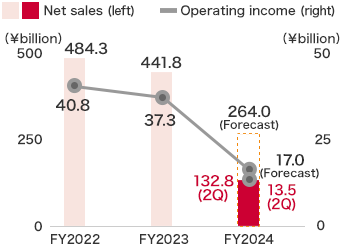

Rental Housing Business

In the Rental Housing Business segment, we have been proposing and supporting rental housing management that maximizes the asset value for owners by providing sustainable value while considering tenants, the global environment and the community. In addition, the Company sought to popularize ZEH-M properties that reduce environmental impact and support the saving and generation of energy.

In March 2025, to commemorate its 70th anniversary, the Company launched THE STATELY, heavy steel-framed girder rigid three- and four-storied rental housing products compliant with ZEH-M (*) standards, throughout Japan (excluding Hokkaido, Okinawa and some other areas). These three- and four-storied rental housing products achieve seismic grade 3, the highest earthquake resistance level under Japan’s building codes, and the first floor is suitable for various uses beyond residential purposes, including retail spaces and offices, offering the opportunity for proposals to meet the specific needs of the construction area. Going forward, the Company will continue proposing a wide range of potential land uses to owners and offering rental housing that is chosen by tenants.

At Daiwa Living Co., Ltd., in addition to providing high-quality, comfortable rental housing “D-ROOM” which is chosen by a wide variety of tenants, it has also succeeded in creating competitive rooms for managed properties. As a result, the number of properties under management has increased and a high occupancy rate has been maintained.

Daiwa House Chintai Reform Co., Ltd. worked to strengthen relationships by conducting building inspections and diagnoses periodically at rental houses constructed by the Company, while also promoting warranty extension work and renovation proposals.

Meanwhile, overseas in the U.S., where the Company is developing rental housing, the Company sold Parkside, part of the Esterra Park Project development in a suburb of Seattle, in November 2024. In the same month, the Company made Alliance Residential Company, a rental housing developer in the U.S., an equity-method affiliate. The Company aims to strengthen the Group’s network and ability to propose solutions in the U.S. to expand its real estate development platform in the region.

As a result, net sales for this segment amounted to 1,376,089 million yen (+10.1% year on year), while operating income came to 129,960 million yen (+12.2% year on year).

* ZEH-M Stands for Net-Zero Energy House for Multiple dwellings. Refers to multi-unit residential buildings that aim to achieve net-zero energy consumption through high insulation and energy-saving performance, and the use of renewable energy.

Condominiums Business

In the Condominiums Business segment, we sought to provide basic housing performance essential for a long housing life, comfort, safety and a management structure, drawing on our knowhow as a home builder to meet the diverse lifestyle needs of potential residents.

In March 2025, PREMIST Tower Senrioka (Osaka) started being sold. PREMIST Tower Senrioka is a 36-story condominium, jointly developed by four company joint venture, including the Company, on the site of the Senrioka Station West Area Type One Urban Redevelopment Project being implemented by Settsu City on the west side of Senrioka Station on the JR Tokaido Main Line. Sales are going well, reflecting appreciation of the surrounding environment, enhanced through the redevelopment project to include a pedestrian deck connecting the building and the station and adjacent commercial facilities, as well as the comfortable living environment, including a range of common facilities and amenities.

In January 2025, Daiwa Lifenext Co., Ltd. successfully completed a demonstration experiment for the integration of robotics and security systems in collaboration with Octa Robotics, Inc. and SOHGO SECURITY SERVICES CO., LTD. Selected as an “FY2024 Project to Construct a Basis for Research and Development of Innovative Robots” by the Ministry of Economy, Trade and Industry, this experiment confirmed that robots are capable of autonomously operating a security system and providing security and cleaning services in unmanned environments. This opens up the possibility of creating environments where robots can move around buildings more freely and independently. Going forward, the company will work with partner companies to strengthen various aspects of security associated with the operation of robots and achieve the simultaneous operation of multiple robots. The company will also accelerate initiatives for the development and sale of new building management services that will help improve management quality.

Overseas, the development of condominiums in the U.S. and in London, the U.K. are progressing well.

However, mainly due to the change of Cosmos Initia Co., Ltd. from a consolidated subsidiary of the Company into an affiliate accounted for by the equity method in the previous consolidated fiscal year, net sales for this segment amounted to 269,427 million yen (-39.0% year on year), while operating income came to 10,908 million yen (-70.8% year on year).

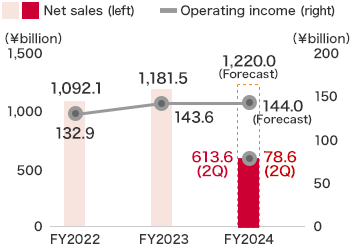

Commercial Facilities Business

In the Commercial Facilities Business segment, we offered various plans that meet the needs of tenant corporations, taking advantage of their business strategies and the characteristics of each region. In particular, we strengthened our efforts in the field of large-scale properties, and focused on built-for-sale business, in which we sell to investors properties for which we have acquired land, planned development, designed and constructed, and conducted leasing-out to tenants, as well as on the commercial facility brokerage and purchase and resale businesses.

In the home center business, the total number of home centers operated by Royal Home Center Co., Ltd. as of the end of March 2025 was 64. In February 2025, the company completed the renovation of Royal Home Center Toda-Koen (Saitama Prefecture), enhancing the pet sales space by offering pets and high-quality pet foods, which are not stocked by regular stores.

In the urban hotels business, the occupancy rate of Daiwa Roynet Hotels, which is operated by Daiwa House Realty Mgt. Co., Ltd., remained strong due to demand from inbound tourists. The cumulative average occupancy rate for the fiscal year 2024 was 88.5%. Daiwa Roynet Hotel Akita Ekimae opened in February 2025 and BATON SUITE OKINAWA-KOURIJIMA, the company’s first resort hotel, opened in March 2025.

In the fitness club business, Sports Club NAS Co., Ltd. stepped up sales promotions. As a result, in the current consolidated fiscal year, the number of club memberships reached around 150% of the level a year earlier. The company will continue providing training to sales staff in a bid to improve sales further.

In January 2025, Daiwa Lease Co., Ltd. reopened Sogo Recreation Park and Shinsakongawa Water Park in Edogawa Ward, Tokyo, following renovation. The renovated parks are in the Kasai area in the southern part of Edogawa Ward. The Ward floated a tender for the renovation work and a group led by the company was selected as the project coordinator. The company will be responsible for maintaining the park facilities including play equipment and park walkways, benches and toilets and for operating cafes, restaurants, barbecues and other facilities, and will aim to offer facilities that are loved by many users.

Overseas, in Kaohsiung, Taiwan, the Taiwan Kaohsiung Project*, a mixed-use development project consisting of a hotel and a condominium underway since January 2020, the hotel building was completed and the Hotel Nikko Kaohsiung opened in November 2024.

As a result, net sales for this segment amounted to 1,227,145 million yen (+3.9% year on year), while operating income came to 145,928 million yen (+1.6% year on year).

* The Company participated in the project through investment in Fanlu Construction Industry Co., Ltd., which was established by Continental Development Corporation, a leading property developer in Taiwan.

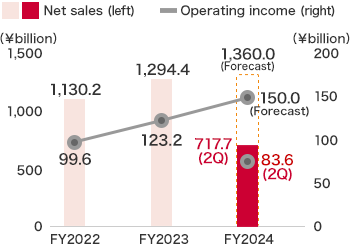

Logistics, Business & Corporate Facilities Business

In the Logistics, Business & Corporate Facilities Business segment, we worked to enhance the Group’s business scope by constructing a variety of facilities to suit the differing business needs of our corporate customers, and by providing total support services that enable customers to utilize their assets most effectively.

Regarding logistics facilities, we have commenced construction on the large-scale rental facility DPL Fukuoka East in Kyushu region where demand was strong, during the three months from January 2025. Leasing is also progressing steadily, and lease agreements have been concluded for DPL Sapporo South Ⅲ・Ⅳ, DPL Okinawa Tomigusuku Ⅰ, DPL Iwate Hanamaki and DPL Odawara (Kanagawa Prefecture).

In the Livness business, the Company conducted the purchase-and-resale of four properties in the three months from January 2025. These were Hitachinaka City Yamazaki Livness Project, Numazu City Nishijima-cho Nursing Home, D Project Livness Project Nagoya City Showa-Ku Gokiso, and Koga City Chayashinden Livness Project.

In the food-related business, inquiries about frozen food manufacturing plants and cold storage and refrigerated warehouses increased alongside growing demand for meal replacement products. Meanwhile, in pharmaceutical and health foods markets, demand for high quality logistics centers also grew.

Daiwa House Property Management Co., Ltd., a company that manages and operates logistics facilities developed mainly by the Company, concluded new property management (PM) agreements for 6 logistics facilities including DPL Komaki (Aichi Prefecture) in the three-month period from January 2025, increasing the number of facilities managed by the company and the area under management as of the end of March 2025 to 258 buildings and approximately 10.70 million square meters.

In the IT business of the Daiwa LogiTech Group, which is engaged in the logistics services business, orders were firm as client companies continued to increase investment to promote DX. Financial results in the IT business were in line with targets. The company will continue focusing on logistics automation and labor-saving projects, to help it gain more new customers. Meanwhile, in the logistics business, earnings struggled to grow due to the impact of a review of contracts with major customers; however, the company will focus on cost improvements at all centers while at the same time improving performance by gaining new customers to fill unused space.

Fujita Corporation performed strongly, winning orders for large-scale construction projects such as residential buildings, factories and civil engineering projects including land reclamation work for land readjustment and windfarm construction work.

In overseas business, we opened DPL Vietnam Minh Quang, our first multi-tenant logistics facility developed in northern Vietnam, in February 2025. This facility was developed in a joint project with WHA Corporation PCL, one of Thailand’s leading developers of logistics facilities and factories. Going forward, the Company will continue accelerating the development of logistics, business & corporate facilities in the U.S. and ASEAN and other countries.

As a result, net sales for this segment amounted to 1,369,730 million yen (+5.8% year on year), while operating income came to 159,655 million yen (+29.5% year on year).

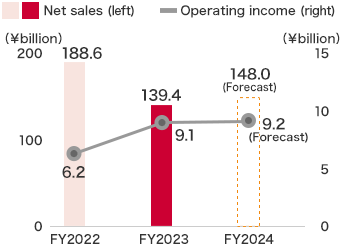

Environment and Energy Business

In the Environment and Energy Business, amid the current acceleration of transition toward decarbonization and the growing demand for renewable energy, the Group promoted three businesses, the EPC business (design and construction of power plants for renewable energy), the PPS business (electric power retail business) and the IPP business (electric power generation business).

In the EPC business, the Group is working to expand two PPA-related businesses, off-site PPA (Power Purchase Agreement) with the goal of supplying renewable energy to a purchaser far from a solar power generation facility and on-site PPA with the goal of supplying renewable energy directly from a solar power generation facility installed on a roof or in an adjacent area. Demand for renewable energy is increasing steadily. The Company will leverage the land development knowhow it has built up since its foundation to secure sites for solar power generation facilities in suitable locations and will collaborate with major energy companies to develop users, and will continue focusing efforts on the EPC business as a mainstay business.

In the PPS business, record-high profits were achieved due to the stabilization of spot prices in the electricity wholesale market, alongside initiatives such as introduction of power procurement adjustment costs (fuel cost adjustments set independently). Given the difficulty in predicting trends in the business environment in the electric power industry, we will work to stabilize the PPS business while taking measures to address the risks of the business.

In the IPP business, the Company engages in the operation of wind power generation and hydroelectric power generation, as well as solar power generation, which is its main business, at 677 locations nationwide, with total generation capacity of 894 MW.

In addition to entering the battery storage business, we also have our sights set on overseas business expansion. We signed a joint venture agreement with WHA Corporation PCL, a developer of logistics facilities and plants in Thailand, and began offering PPA model self-consumption solar power generation equipment (on-site PPA) for the first time overseas from February 2025. Leveraging the knowhow it has accumulated in its businesses to date, the Company aims to achieve more widespread use of renewable energy.

As a result, net sales for this segment amounted to 131,180 million yen (-5.9% year on year), while operating income came to 12,420 million yen (+36.0% year on year).

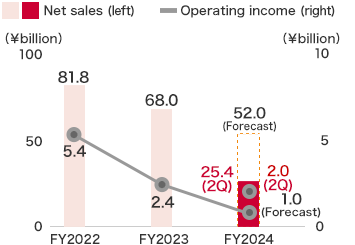

Other Businesses

Net sales for this segment amounted to 50,918 million yen (-25.2% year on year), while operating income came to 2,840 million yen (+15.9% year on year).

Notes:

1. Net sales for each segment include internal (inter-segment) sales and transfers in addition to sales to external customers.

2. The above monetary amounts are exclusive of consumption tax, etc.