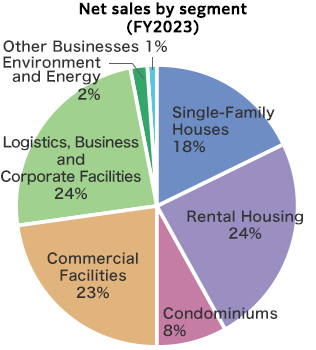

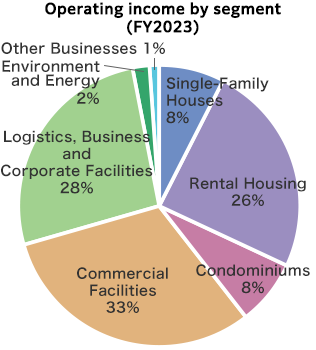

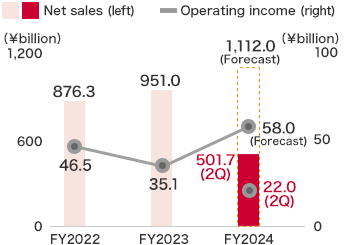

Business Segment*This page is updated semi-annually.

The percentage figures for breakdown of net sales and operating income by segment

- *Net sales represents sales to external customers.

- *Adjustments are included in the total but not shown on the graph. The percentage of each segment does not add up to 100%.

Single-Family Houses Business

In the Single-Family Houses Business segment, we provided high-quality housing with excellent energy efficiency and resilience performance amid the diversification of housing styles. We stayed close to residents’ lives and their changing values to propose lifestyles that will enhance their lives.

In the domestic housing business, the Company promoted the new “Ready Made Housing.” concept which inherits the quality of custom-built houses to strengthen initiatives for built-for-sale houses. The Company provides high-quality built-for-sale houses that aim to be worth more than their price, offering the same design excellence and quality as custom-built houses, a reassuring long-term home warranty, and after-sales support.

For custom-built houses, the Company promoted the “Smart Made Housing.” concept providing the benefits of both custom designs and standardized houses. To further enhance the quality of our innovative proposals, the Company also utilized a VR presentation tool and strengthened sales of semi-custom houses (Smart Design) and standardized houses (Smart Selection). Additionally, the Company focused on increasing the percentage of its sales that are Net Zero Energy Houses (ZEH), not only by offering xevoΣ, its mainstay steel-framed housing product, and skye, a three- to five-story housing product, but also xevo GranWood, a wooden housing product, and Wood Residence MARE, the Company’s top-quality single-family house designed for affluent customers. These efforts reflect the Company’s commitment to achieving carbon neutrality and responding the diverse needs of its customers.

Moreover, anticipating a society with a high demand for housing stock, the Company is focusing on the revitalization and regeneration of existing buildings. Especially in housing complexes developed by the Company, it works on the Livness Town Project, which aims to regenerate and redevelop communities by addressing social issues such as community revitalization and the problem of vacant houses. The Company tries to put itself in the shoes of those who live there and maintains a close relationship with the communities and the residents’ daily lives, so as to enhance the value of communities and ensure they remain attractive places to live for many years more.

Overseas, the Group has been expanding its operations in the eastern, southern and western regions of the United States, which it calls the smile zone. Three Group companies, Stanley Martin Holdings, CastleRock Communities and Trumark Companies play a key role in the east, south and west respectively. Sales in the U.S. housing market were slow from the beginning of the year, primarily due to high interest rates and rising economic uncertainty. However, the Group successfully increased the number of residential subdivisions and implemented effective sales strategies. As a result, the cumulative number of orders received from January to June 2025 increased compared to the previous fiscal year.

As a result, net sales for this segment amounted to 541,206 million yen (+7.9% year on year), while operating income came to 23,448 million yen (+6.4% year on year).

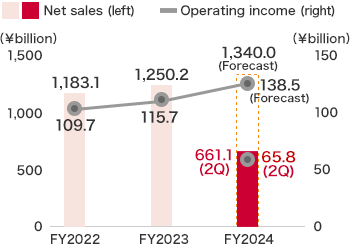

Rental Housing Business

In the Rental Housing Business segment, we have been proposing and supporting rental housing management that maximizes the asset value for owners by providing sustainable value while considering tenants, the global environment and the community. In addition, the Company sought to popularize ZEH-M properties that reduce environmental impact and support the saving and generation of energy, while also promoting to increase property scale in line with broader land utilization proposals for owners.

At Daiwa Living Co., Ltd., in addition to providing high-quality rental housing under the “D-ROOM” brand, the company has implemented various initiatives to enhance the value of managed properties, such as proposing the installation of equipment that improves daily convenience and undertaking other related efforts. These efforts have led to an increase in the number of properties under management and the continued maintenance of a high occupancy rate.

Daiwa House Chintai Reform Co., Ltd. worked to strengthen relationships by conducting building inspections and diagnoses periodically at rental houses constructed by the Company, while also promoting warranty extension work and renovation proposals.

As part of its overseas operations in the U.S., the second phase of a project in Houston, Texas —following the completion of the first phase in June 2024—was completed in August 2025, establishing a 470-unit low-rise rental housing community. The Company aims to achieve the stable operation of its owned properties at an early stage. While closely monitoring market trends, the Company intends to sell units at the optimal time.

In addition, the Company has been strengthening collaboration in real estate development with Alliance Residential Company, which became an equity-method affiliate last year.

As a result, net sales for this segment amounted to 703,196 million yen (+6.4% year on year), while operating income came to 75,038 million yen (+14.0% year on year).

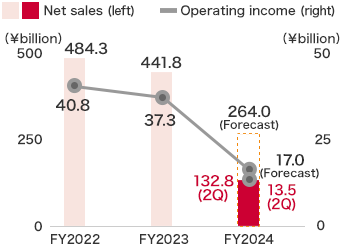

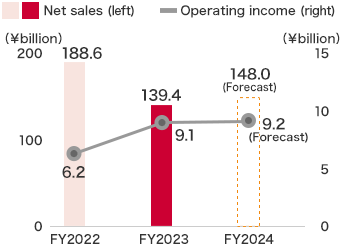

Condominiums Business

In the Condominiums Business segment, we sought to provide basic housing performance essential for a long housing life, comfort, safety and a management structure, drawing on our know-how as a home builder to meet the diverse lifestyle needs of potential residents.

In August 2025, the Company started selling units of Kurume The Tower Residential (Fukuoka Prefecture), which is a 36-story earthquake-resistant tower condominium. The property is located just a one-minute walk from Kurume Station, which services the Kyushu Shinkansen Line and the JR Kagoshima Main Line. It is the largest and tallest condominium in the area. The condominium is part of a mixed-use redevelopment project in front of the station featuring residential and commercial facilities. The various plans for the building, which include convenient living options and shared amenities, such as a sky lounge and a fitness room, have been well received. As a result, sales are progressing successfully.

Daiwa Lifenext Co., Ltd. has provided the TAKSTYLE external condominium management service since September 2022, and as of September 30, 2025, it was being used by 174 cases. The aging population and the increase in the number of dual-income households have led to a shortage of condominium management association board members. Consequently, TAKSTYLE has been increasingly adopted by management associations of both newly built and existing condominiums to enhance the quality of management by leveraging specialized expertise in condominium operations. Leverage its expertise in management operations, it aims to ease the burdens on management association members and contribute to a safe, secure, and comfortable living environment while enhancing the asset value of condominiums.

As a result, net sales for this segment amounted to 134,200 million yen (+1.0% year on year), while operating income came to 7,580 million yen (-44.2 year on year).

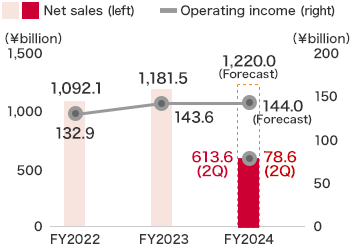

Commercial Facilities Business

In the Commercial Facilities Business segment, we offered various plans that meet the needs of tenant corporations, taking advantage of their business strategies and the characteristics of each region. In particular, we strengthened our efforts in the field of large-scale properties, and focused on built-for-sale business, in which we sell to investors properties for which we have acquired land, planned development, designed and constructed, and conducted leasing-out to tenants, as well as on the commercial facility brokerage and purchase and resale businesses.

Daiwa Lease Co., Ltd. opened Frespo Suzuran Plaza in Obihiro, Hokkaido in July 2025. The concept of the facility is “a place where people, things, and experiences come together to create new interactions.” The company aims to create an environment where local residents can enjoy their time without concern, regardless of the weather, with the goal of making the facility the most popular commercial destination in the Tokachi region.

In the urban hotels business by Daiwa House Realty Mgt. Co., Ltd., there has been significant demand due to Expo 2025 Osaka, Kansai, Japan. The hotels in the Kansai region, in particular, performed well, resulting in an average occupancy rate that surpassed the previous year.

In other businesses, in July 2025, Royal Home Center Co., Ltd. had a sale celebrating its 45th anniversary that attracted many customers. At Sports Club NAS Co., Ltd., a review of fixed costs and efficient advertising investments have contributed to improved business performance.

Overseas, the Company embarked on its first hotel development project in Thailand in collaboration with SCX Corporation Co., Ltd., a subsidiary of SC Asset Corporation PLC., a major real estate developer in Thailand. The hotel, KROMO Bangkok, Curio Collection by Hilton (28 floors above ground, 306 guest rooms), was completed in the heart of Bangkok, the capital of Thailand, and opened on September 24, 2025.

As a result, net sales for this segment amounted to 637,101 million yen (+3.8% year on year), while operating income came to 85,000 million yen (+8.1% year on year).

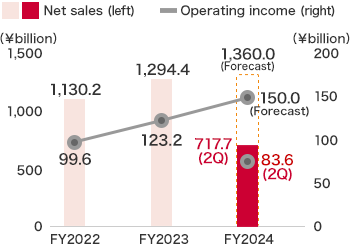

Logistics, Business & Corporate Facilities Business

In the Logistics, Business & Corporate Facilities Business segment, we worked to enhance the Group’s business scope by constructing a variety of facilities to suit the differing business needs of our corporate customers, and by providing total support services that enable customers to utilize their assets most effectively.

Regarding logistics facilities, construction of DPL Kawagoe (Saitama Prefecture), DPL Kazo (Saitama Prefecture) and DPL Ishikawa Hakusan commenced between July 2025 and September 2025. In addition, three large-scale properties—DPL Chiba Yotsukaido II, DPL Chiba Railgate, and DPL Fukushima Nihonmatsu—were completed.

In the medical and nursing care facilities business, the construction of a private hospital began in Saitama Prefecture. A private rehabilitation hospital is currently under construction in Hiroshima Prefecture, and a private hospital has been completed in Hokkaido. Going forward, the Company will continue not only with medical and nursing care-related projects, but also with initiatives involving complex buildings, R&D facilities, and urban development proposals and related planning activities.

In the property management business, Daiwa House Property Management Co., Ltd., a company that manages and operates logistics facilities developed mainly by the Company, concluded new three property management (PM) agreements for logistics facilities, including DPL Chiba Yotsukaido II. As a result, the number of facilities under management and the total managed area reached 262 buildings and approximately 11.15 million square meters as of the end of September 2025.

In the logistics business, Daiwa Logistics Co., Ltd. is taking steps to comply with the recent revisions to two logistics laws. The company is actively expanding its 3PL business* with a focus on logistics center operations as a core business area.

Overseas, the Company continued to develop multi-tenant logistics facilities in the U.S. and ASEAN countries. In September 2025, the Blue Ridge Commerce Center, the Company’s first logistics facility development project in the U.S., was completed and began operations. In addition, DPL Malaysia III, which boasts the largest total floor area among the Company’s overseas logistics facilities, was also completed. Going forward, the Company will continue to accelerate the development of commercial facilities.

However, due to decline in the sale of development properties, net sales for this segment amounted to 591,865 million yen (-17.5% year on year), while operating income came to 61,793 million yen (-26.2% year on year).

* Stands for “Third-party logistics.” An outsourcing service that proposes logistics reforms to cargo owners and undertakes a fully integrated flow of physical distribution of cargoes from the cargo owners.

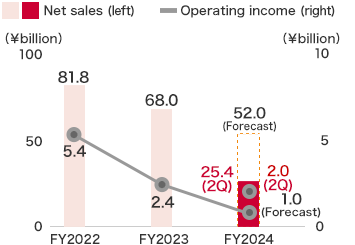

Environment and Energy Business

In the Environment and Energy Business, amid the current acceleration of transition toward decarbonization and the growing demand for renewable energy, the Group promoted three businesses, the EPC business (design and construction of power plants for renewable energy), the PPS business (electric power retail business) and the IPP business (electric power generation business).

In the EPC business, the Group is working to expand two PPA-related businesses, off-site PPA (Power Purchase Agreement) with the goal of supplying renewable energy to a purchaser far from a solar power generation facility and on-site PPA with the goal of supplying renewable energy directly from a solar power generation facility installed on a roof or in an adjacent area. Demand for renewable energy is increasing steadily. The Company will leverage the land development knowhow it has built up since its foundation to secure sites for solar power generation facilities in suitable locations and will collaborate with major energy companies to develop users, and will continue focusing efforts on the EPC business as a mainstay business.

In the PPS business, profit remained stable due to the stabilization of spot prices in the electricity wholesale market, as well as initiatives such as the introduction of independently set fuel cost adjustments. While maintaining relationships with existing customers, the Company aims to expand contracted capacity. Given the difficulty of predicting trends in the business environment in the electric power industry, we will continue implementing measures to mitigate business risks.

In the IPP business, the Company engages in the operation of wind, hydroelectric, and solar power generation—its core business—at 758 locations nationwide, with total generation capacity of 959 MW as of September 30, 2025.

The Company is launching a new initiative to enter the power storage station business. It plans to begin operating a station in July 2026. Currently, the Company is preparing for a grid-connected power storage station demonstration project at its Kyushu Plant.

In overseas operations, the Company commenced its first overseas PPA model self-consumption solar power generation equipment (on-site PPA) through a joint venture with WHA Corporation PCL, a developer of logistics facilities and factories in Thailand.

Leveraging the know-how and relationships cultivated through its existing businesses, the Company aims to achieve more widespread use of renewable energy.

As a result, net sales for this segment amounted to 65,200 million yen (+3.6% year on year), while operating income came to 7,868 million yen (+9.8% year on year).

Other Businesses

Net sales for this segment amounted to 27,361 million yen (+7.5% year on year), while operating income came to 3,040 million yen (+49.6% year on year).

Notes:

1. Net sales for each segment include internal (inter-segment) sales and transfers in addition to sales to external customers.

2. The above monetary amounts are exclusive of consumption tax, etc.